Brookfield Infrastructure Partners L.P. (BIP, Financial) is a growing collection of high-quality global infrastructure assets.

-Distribution Yield: 5%

-Distribution Growth: 12%

-The partnership has operations in North America, South America, Europe, Asia, and Australia.

Overall, I find Brookfield Infrastructure to be a great business to invest in on price dips. I’m willing to pick up units under $30.

Transelec- Electric transmission lines in Chile

Ontario Transmission- Electric transmission lines in Canada

Powerco- Electricity and gas distribution in New Zealand

IEG- Electricity and natural gas connections in UK

EBSA- Electricity distribution in Columbia.

Growth opportunities:

1) Expected $350 million in capital expenditure, with unlevered pre-tax expected returns of 12%.

2) There’s potential for over 60% expansion of Australian coal export terminal, which could require over $3 billion.

Brookfield Rail- Australian rail infrastructure

PD Ports- Collection of shipping ports in UK

Euroports- Ports in Europe and China

IEG Distribution- Sole natural gas distributor in Channel Islands and Isle of Man

TGN- Sole natural gas distributor in Tasmania

Autopista Vespucio Norte- Chilean toll roads

Growth opportunities:

1) Current $600 million expansion of Brookfield railway over 2 years.

2) Up to $100 million in European port expansions and up to $500 million in Australian ports adjacent to railway operations

Longview Timber- timberland in Northwestern US

Growth opportunity:

They’re currently harvesting at 99% of long run sustainable yield, but they can harvest up to 120% during times of high log prices and make up for it with under-harvesting during times of low log prices (which is what they did during the recession).

Surrey Pretrial Services Centre Expansion Project, British Columbia- renovation and operating concession

Quinte Consolidated Courthouse, Ontario- construction and operating concession

Social Infrastructure is a very small part of the partnership.

Since Brookfield Infrastructure is a partnership, it means you’ll generally receive tax advantages as a unitholder compared to a shareholder in a corporation. Your income will typically be taxed fairly modestly, and your taxes will be partially deferred (which is good, because you can use that money for compounding until you pay it). The disadvantage is that a partnership potentially complicates your taxes because you need to file an additional form. This is the type of investment for which it is often prudent to seek advice from a tax or financial adviser.

Cash Flow Stability

Contractual: 41%

Regulated: 38%

Other: 21%

Segment Diversification

Utilities: 32%

Transport and Energy: 53%

Timber: 15%

Global Diversification

Australia: 49%

North America: 28%

Europe: 13%

South America: 10%

FFO (funds from operations) is calculated as net income excluding several items such as depreciation, amortization, deferred taxes, and other items, and is among the most meaningful of metrics for an asset-heavy partnership.

Adjusted FFO to subtract maintenance expenditures is another key metric, and generally the single most meaningful. AFFO for 2011 was $1.85 per unit.

The current price per unit is approximately $30. Book value is $22.72.

BIP has been growing its size rapidly due to its acquisition activities. The company fuels these purchases with unit issuance along with a percentage of the FFO, but if performed at attractive valuations, results in increased per-unit performance including FFO and distributions.

Utilities Debt to Assets: 65%

Transportation Debt to Assets: 50%

Timber Debt to Assets: 42%

Other Debt to Assets: 64%

Debt maturities are prudently spread out over a mult-year period.

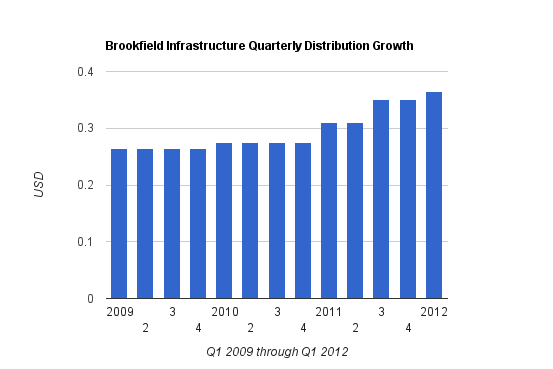

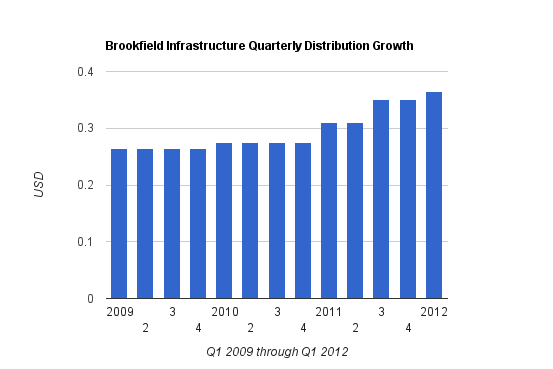

The partnership has grown distributions at an average rate of over 12% over this period, and 2012 assumes that the newly increased distribution will stay static all year (rather than increase mid-year as it did in 2011 but not in 2010 or 2009). The management team targets 3-7% long-term distribution growth.

Partnership management has made very prudent acquisitions and investments over the past 3 years, and has a very large (up to $5 billion) backlog of current and potential future investments for organic growth of their operations. With a fairly low payout ratio, they preserve substantial capital for growth at lucrative rates of return.

Incentive Distribution Rights

Brookfield Infrastructure has a rather low level of incentive distribution rights (IDRs) to the general partner. Many publicly traded partnerships have agreements where once certain target distribution levels are paid to limited partners, the general partner is entitled to up to 15%, 25%, and eventually 50% of total cash. Often, 50% is the highest target level (although mathematically, they never actually reach 50%; they just approach it as they grow the distribution). As the general partner is entitled to a percentage of cash approaching 50%, it increases the cost of capital for the partnership, because any new projects or acquisitions need to provide a large enough return to grow distributions to limited partners- despite paying a substantial percentage of the returns to the general partner.

Brookfield Infrastructure, on the other hand, has a maximum IDR distribution agreement for 25%. So the distribution situation will approach 25% of available cash going to the general partner, plus a management fee, and 75% going to the limited partners. This keeps the long term cost of capital very reasonable.

Target Returns

BIP management has stated that they expect to grow the distribution at 3-7% per year. With an approximately 5% distribution yield per year, that provides for roughly 8-12% total returns, assuming a constant yield.

In contrast, BIP management has stated that 12-15% total returns are targeted. This implies achieving distribution growth on or above the top end of the target distribution growth. In recent years, their returns have far outpaced their expectations. Based on past performance combined with somewhat more conservative future assumptions, I’m fairly optimistic that Brookfield Infrastructure can meet the long-term midpoint of their targets or higher. Low double digit returns in this environment are fairly appealing.

One thing I like is that their risk is spread out on almost every continent and several countries. But much of their success is indirectly driven by China and other growth areas in Asia, and any major setback in these countries could have adverse affects on Brookfield Infrastructure (and particularly, their timber businesses and their Australian commodity infrastructure, which are some of their most attractive assets). In addition, entities like this that have attractive tax structures carry the risk of not meeting their requirements to remain a partnership, and are vulnerable to tax reform.

BIP has invested more heavily in Australia than previously projected, and now a full 49% of the business is invested in Australia. In addition, several of the largest growth opportunities remain in Australia, such as the potential for a multi-billion dollar coal terminal expansion, the continued expansion of the Australian railway, and the potential for Australian ports. To a certain extent, this concentrates risk to the region, and concentrates risk to Chinese consumption of Australian exports. I view these assets as some of the partnership’s most attractive assets, but with the concentration, I also view them as the largest risks now.

A global slowdown, and particularly a Chinese slowdown, would likely greatly affect these assets, and also their timber sales. The good news is that in times of recession, BIP management may have additional attractive acquisition opportunities like they did in this past recession. But it would be financially troublesome if BIP were to over-extend with infrastructure in this region.

Brookfield Infrastructure has:

-Leverage/interest risk

-Currency risk

-Pricing risk (timber)

-Volume risk (ports, terminals)

-Regulation risk (electricity, other utilities)

-Tax Reform risk

-Australian weather risk

-Chinese economic risk

-other risks not insured

I find the current valuation reasonable, albeit without much margin of safety. I calculate that the current $30 unit cost is fair. In June of 2011, the distribution yield was around 5% and I stated that the valuation was fair, but I’d look to buy on dips. In August 2011, I provided an update when the yield was closer to 6% and stated that due to the distribution increase and positive results, it looked like a good buy. It has since continued to climb, and is now back down to a 5% yield on the current (higher) distribution. In other words, these guidelines have been rather prudent so far. I find both Brookfield Infrastructure Partners and Energy Transfer Equity (ETE, Financial) to be good places to look for partnership investments.

Based on the multiples and the payout ratio, I’m generally willing to pick up more units of Brookfield Infrastructure during times when the distribution yield is over 5% as a minimum. I prefer above 5.5%. So the current price of around $30 or under qualifies for the minimum end of my buying range.

Full Disclosure: I own units of BIP and ETE.

-Distribution Yield: 5%

-Distribution Growth: 12%

-The partnership has operations in North America, South America, Europe, Asia, and Australia.

Overall, I find Brookfield Infrastructure to be a great business to invest in on price dips. I’m willing to pick up units under $30.

Overview

Brookfield Infrastructure Partners, L.P. (BIP) is a publicly traded partnership that was spun off from Brookfield Asset Management (BAM, Financial). Brookfield Infrastructure’s businesses are, as you could have guessed by the name, all about infrastructure. They own (or hold a joint venture with) the following infrastructure:Utilities, $1,324 million in partnership capital:

DBCT- Enormous coal terminal that provides port export services from AustraliaTranselec- Electric transmission lines in Chile

Ontario Transmission- Electric transmission lines in Canada

Powerco- Electricity and gas distribution in New Zealand

IEG- Electricity and natural gas connections in UK

EBSA- Electricity distribution in Columbia.

Growth opportunities:

1) Expected $350 million in capital expenditure, with unlevered pre-tax expected returns of 12%.

2) There’s potential for over 60% expansion of Australian coal export terminal, which could require over $3 billion.

Transportation and Energy, $2,214 million in partnership capital:

NGPL- Natural gas storage and pipeline in the USBrookfield Rail- Australian rail infrastructure

PD Ports- Collection of shipping ports in UK

Euroports- Ports in Europe and China

IEG Distribution- Sole natural gas distributor in Channel Islands and Isle of Man

TGN- Sole natural gas distributor in Tasmania

Autopista Vespucio Norte- Chilean toll roads

Growth opportunities:

1) Current $600 million expansion of Brookfield railway over 2 years.

2) Up to $100 million in European port expansions and up to $500 million in Australian ports adjacent to railway operations

Timber, $648 million in partnership capital:

Island Timberlands- timberland in British ColumbiaLongview Timber- timberland in Northwestern US

Growth opportunity:

They’re currently harvesting at 99% of long run sustainable yield, but they can harvest up to 120% during times of high log prices and make up for it with under-harvesting during times of low log prices (which is what they did during the recession).

Social Infrastructure:

Peterborough Hospital- UK hospitalSurrey Pretrial Services Centre Expansion Project, British Columbia- renovation and operating concession

Quinte Consolidated Courthouse, Ontario- construction and operating concession

Social Infrastructure is a very small part of the partnership.

Partnership Advantage

The advantage of a publicly traded partnership over a corporation is that a partnership is not subject to as much double taxation as corporations are. When a corporation makes a profit, they are heavily taxed on that profit. Then, out of their after-tax profit, they may pay dividends to shareholders, and the shareholders then have to pay taxes on those dividends. So each dollar of a dividend is taxed twice- once at the corporate level and once at the shareholder level. Brookfield Infrastructure is a partnership and so is a flow-through entity. Unit-holders of a partnership pay taxes on their portion of the income. This way, earnings are only taxed once- at the individual level. It’s usually advantageous to be a partnership over a corporation, but the law only allows certain types of entities to become partnerships.Since Brookfield Infrastructure is a partnership, it means you’ll generally receive tax advantages as a unitholder compared to a shareholder in a corporation. Your income will typically be taxed fairly modestly, and your taxes will be partially deferred (which is good, because you can use that money for compounding until you pay it). The disadvantage is that a partnership potentially complicates your taxes because you need to file an additional form. This is the type of investment for which it is often prudent to seek advice from a tax or financial adviser.

Cash Flow Stability

Contractual: 41%

Regulated: 38%

Other: 21%

Segment Diversification

Utilities: 32%

Transport and Energy: 53%

Timber: 15%

Global Diversification

Australia: 49%

North America: 28%

Europe: 13%

South America: 10%

Growth

Brookfield Infrastructure was hit fairly hard in the financial crisis, but has rebounded nicely, and the more regulated and stable parts of its business act as a useful buffer for the more volatile and economy-dependent aspects.Funds from Operations Growth

| Year | FFO Per Unit |

|---|---|

| 2011 | $2.41 |

| 2010 | $1.79 |

| 2009 | $1.03 |

| 2008 | $1.54 |

Adjusted FFO to subtract maintenance expenditures is another key metric, and generally the single most meaningful. AFFO for 2011 was $1.85 per unit.

The current price per unit is approximately $30. Book value is $22.72.

Limited Partnership Capital Growth

| Year | Partnership Capital |

|---|---|

| 2010 | $4,206 million |

| 2010 | $3,357 million |

| 2009 | $1,858 million |

| 2008 | $900 million |

Balance Sheet

BIP has a reasonable balance sheet for an asset-heavy infrastructure business.Utilities Debt to Assets: 65%

Transportation Debt to Assets: 50%

Timber Debt to Assets: 42%

Other Debt to Assets: 64%

Debt maturities are prudently spread out over a mult-year period.

Distribution

Brookfield Infrastructure currently pays cash distributions (similar to dividends) of $0.375 per unit per quarter, or $1.50 per unit per year. As of this writing, that is a 5.02% distribution yield. Management targets to grow the distribution by 3-7% going forward and pay out 60-70% of FFO. The current payout is on the low end of this range.Distribution Growth

| Year | Distribution |

|---|---|

| 2012 | $1.50* |

| 2011 | $1.32 |

| 2010 | $1.10 |

| 2009 | $1.06 |

Investing Thesis

Brookfield Infrastructure represents a good opportunity to invest in high quality, safe, cash-generating assets like utilities while also buying higher growth assets that are more sensitive to global economic trends. I particularly like their Australian infrastructure. Their coal export terminal, DCBT, in northeastern Australia serves Japan, Korea, China, and India, so they have direct access to emerging economic powerhouses.Partnership management has made very prudent acquisitions and investments over the past 3 years, and has a very large (up to $5 billion) backlog of current and potential future investments for organic growth of their operations. With a fairly low payout ratio, they preserve substantial capital for growth at lucrative rates of return.

Incentive Distribution Rights

Brookfield Infrastructure has a rather low level of incentive distribution rights (IDRs) to the general partner. Many publicly traded partnerships have agreements where once certain target distribution levels are paid to limited partners, the general partner is entitled to up to 15%, 25%, and eventually 50% of total cash. Often, 50% is the highest target level (although mathematically, they never actually reach 50%; they just approach it as they grow the distribution). As the general partner is entitled to a percentage of cash approaching 50%, it increases the cost of capital for the partnership, because any new projects or acquisitions need to provide a large enough return to grow distributions to limited partners- despite paying a substantial percentage of the returns to the general partner.

Brookfield Infrastructure, on the other hand, has a maximum IDR distribution agreement for 25%. So the distribution situation will approach 25% of available cash going to the general partner, plus a management fee, and 75% going to the limited partners. This keeps the long term cost of capital very reasonable.

Target Returns

BIP management has stated that they expect to grow the distribution at 3-7% per year. With an approximately 5% distribution yield per year, that provides for roughly 8-12% total returns, assuming a constant yield.

In contrast, BIP management has stated that 12-15% total returns are targeted. This implies achieving distribution growth on or above the top end of the target distribution growth. In recent years, their returns have far outpaced their expectations. Based on past performance combined with somewhat more conservative future assumptions, I’m fairly optimistic that Brookfield Infrastructure can meet the long-term midpoint of their targets or higher. Low double digit returns in this environment are fairly appealing.

Risk

The partnership has elements of both risk and safety. On one hand, they hold necessary infrastructure like utilities, and they have long-term profitable contracts and giant economic moats around their businesses. On the other hand, they are rather leveraged like almost all asset-heavy businesses are, and some of their businesses such as timber, ports, and terminals are very dependent on the global economy.One thing I like is that their risk is spread out on almost every continent and several countries. But much of their success is indirectly driven by China and other growth areas in Asia, and any major setback in these countries could have adverse affects on Brookfield Infrastructure (and particularly, their timber businesses and their Australian commodity infrastructure, which are some of their most attractive assets). In addition, entities like this that have attractive tax structures carry the risk of not meeting their requirements to remain a partnership, and are vulnerable to tax reform.

BIP has invested more heavily in Australia than previously projected, and now a full 49% of the business is invested in Australia. In addition, several of the largest growth opportunities remain in Australia, such as the potential for a multi-billion dollar coal terminal expansion, the continued expansion of the Australian railway, and the potential for Australian ports. To a certain extent, this concentrates risk to the region, and concentrates risk to Chinese consumption of Australian exports. I view these assets as some of the partnership’s most attractive assets, but with the concentration, I also view them as the largest risks now.

A global slowdown, and particularly a Chinese slowdown, would likely greatly affect these assets, and also their timber sales. The good news is that in times of recession, BIP management may have additional attractive acquisition opportunities like they did in this past recession. But it would be financially troublesome if BIP were to over-extend with infrastructure in this region.

Brookfield Infrastructure has:

-Leverage/interest risk

-Currency risk

-Pricing risk (timber)

-Volume risk (ports, terminals)

-Regulation risk (electricity, other utilities)

-Tax Reform risk

-Australian weather risk

-Chinese economic risk

-other risks not insured

Conclusion and Valuation

For the full fiscal year 2011, Brookfield Infrastructure had $2.41 in FFO and $1.85 in AFFO. They’re currently paying an annualized distribution of $1.50. At nearly $30/unit, the current FFO multiple is about 12.5, and the current AFFO multiple is about 16.2. The distribution yield is 5%. Approximately 60% of FFO, or 80% of AFFO, is currently paid out as the distribution.I find the current valuation reasonable, albeit without much margin of safety. I calculate that the current $30 unit cost is fair. In June of 2011, the distribution yield was around 5% and I stated that the valuation was fair, but I’d look to buy on dips. In August 2011, I provided an update when the yield was closer to 6% and stated that due to the distribution increase and positive results, it looked like a good buy. It has since continued to climb, and is now back down to a 5% yield on the current (higher) distribution. In other words, these guidelines have been rather prudent so far. I find both Brookfield Infrastructure Partners and Energy Transfer Equity (ETE, Financial) to be good places to look for partnership investments.

Based on the multiples and the payout ratio, I’m generally willing to pick up more units of Brookfield Infrastructure during times when the distribution yield is over 5% as a minimum. I prefer above 5.5%. So the current price of around $30 or under qualifies for the minimum end of my buying range.

Full Disclosure: I own units of BIP and ETE.