On Tuesday, Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial) disclosed its equity portfolio for the fourth quarter of 2021, which ended on Dec. 31.

The renowned Guru took three new positions in the fourth quarter: Nu Holdings Ltd (NU, Financial), Activision Blizzard Inc. (ATVI, Financial) and Liberty Formula One Group (FWONK, Financial). It also added to its existing positions in Chevron Corp. (CVX, Financial), Liberty SiriusXM Group (LSXMA, Financial), Floor & Decor Holdings Inc. (FND, Financial) and RH (RH, Financial).

The value investor did just as much selling as buying, selling out of the firm’s investments in Teva Pharmaceutical Industries Ltd (TEVA, Financial) and Sirius XM Holdings Inc. (SIRI, Financial) and reducing its positions in AbbVie Inc. (ABBV, Financial), Bristol-Myers Squibb Co. (BMY, Financial), Marsh & McLennan Companies Inc. (MMC, Financial), Visa Inc. (V, Financial), Charter Communications Inc. (CHTR, Financial), Royalty Pharma PLC (RPRX, Financial), Mastercard Inc. (MA, Financial) and The Kroger Co. (KR, Financial).

As of the quarter’s end, Berkshire’s five largest holdings, accounting for over half of the equity portfolio, were Apple Inc. (AAPL, Financial) with 47.60% of the equity portfolio, Bank of America Corp. (BAC, Financial) with 13.58%, American Express Co. (AXP, Financial) with 7.49%, The Coca-Cola Co. (KO, Financial) with 7.16% and Kraft Heinz Co. (KHC, Financial) with 3.53%.

The guru’s $330.95 billion equity portfolio consisted of 44 stocks as of Dec. 31. By portfolio weight, the guru was most invested in technology stocks, which account for 49.26% of the portfolio, followed by the financial services sector with a weight of 29.28% and the consumer defensive space with 11.56%.

Nu Holdings Ltd

Buffett disclosed a 107,118,784-share position in Nu Holdings Ltd (NU, Financial), giving it a 0.30% weight in the equity portfolio. The stock traded for an average price of $9.82 per share during the quarter.

The Brazilian digital banking company and provider of various financial products has a $40 billion market cap; its shares were trading around $8.68 on Monday with a price-book ratio of 21.03 and a price-sales ratio of 108.51.

The stock is down 15% since it went public in December of 2021.

Activision Blizzard Inc.

The guru invested in 14,658,121 shares of Activision Blizzard Inc. (ATVI, Financial), allocating a 0.29% portion of the equity portfolio to the stock. During the quarter, shares traded for an average price of $68.02 apiece.

The American video game company, which Microsoft (MSFT, Financial) has plans to acquire, has a $63.49 billion market cap at Feb. 14’s closing price of $81.50. The company has a price-earnings ratio of 23.61, a price-book ratio of 3.60 and a price-sales ratio of 7.24.

The GuruFocus Value chart rates the stock as fairly valued.

Liberty Formula One Group

Buffett took a new position worth 2,118,746 shares in Liberty Formula One Group (FWONK, Financial) after selling out of his previous holding of the stock in the fourth quarter of 2016. The stock now has a 0.04% weight in the equity portfolio. Shares traded at an average price of $58.25 for the quarter.

The group of companies responsible for the promotion of the FIA Formula One World Championship ended Feb. 14 with a market cap of $14.26 billion; the share price was $62.29, the price-earnings ratio was 902.38, the price-book ratio was 2.06 and the price-sales ratio was 7.74.

According to the GuruFocus Value chart, the stock is significantly overvalued.

Chevron Corp

Impacting the equity portfolio by 0.34%, the guru boosted the Chevron Corp. (CVX, Financial) by 33.24%, adding 9,541,517 shares. The average stock price for the quarter was $113.83.

The San Ramon, California-based American energy giant had a $263.46 billion market cap on Monday at the closing share price of $136.67. The price-earnings ratio is 16.79, the price-book ratio is 1.90 and the price-sales ratio is 1.69.

The GuruFocus Value chart rates the stock as fairly valued.

Liberty SiriusXM Group

The guru upped his firm’s stake in Liberty SiriusXM Group (LSXMA, Financial) by 35.98%, or 5,347,320 shares, adding 0.08% to the equity portfolio. During the quarter, shares traded around $50.78 apiece. This trade was reported ahead of the 13F on GuruFocus Real-Time Picks, a Premium feature.

Consisting primarily of Liberty Media Corp.’s ownership interests in SiriusXM and Live Nation Entertainment (LYV), Liberty SiriusXM has a market cap of $18.79 billion as of Feb. 14; at the share price of $50.66, the price-book ratio is 2.07 and the price-sales ratio is 1.82.

According to the GuruFocus Value chart, the stock is fairly valued.

Teva Pharmaceutical Industries Ltd

The guru sold out of the 42,789,295-share investment in Teva Pharmaceutical Industries Ltd (TEVA, Financial), which used to take up 0.14% of the equity portfolio. During the quarter, shares averaged around $9.00 apiece.

Shares of the Israeli international pharmaceutical company ended Monday with a market cap of $9.86 billion, a share price of $8.52, a price-earnigns ratio of 23.41, a price-book ratio of 0.95 and a price-sales ratio of 0.62.

The GuruFocus Value chart rates the stock as fairly valued.

Sirius XM Holdings Inc.

Buffett ditched all 43,658,800 of the firm’s shares in Sirius XM Holdings Inc. (SIRI, Financial); prior to the sale, the stake had a 0.09% portfolio weight. The stock traded for an average price of $6.26 per share in the three months through the end of December.

The leading American broadcasting company has a market cap of $24.36 billion as of Feb. 14. At the share price of $6.17, the company has a price-earnings ratio of 19.91 and a price-sales ratio of 2.95.

According to the GuruFocus Value chart, the stock is modestly undervalued.

AbbVie Inc.

The guru reduced the AbbVie Inc. (ABBV, Financial) holding by 78.93%, selling 11,364,927 shares and slimming the equity portfolio by 0.42%. Shares averaged $118.50 each during the quarter.

The American biopharmaceutical company and creator of Humira had a market cap of $252.81 billion at close on Monday and a per-share price of $143. The price-earnings ratio was 22.17, the price-book ratio was 18.65 and the price-sales ratio was 4.52.

The GuruFocus Value chart rates shares as modestly overvalued.

Bristol-Myers Squibb Co.

The Oracle of Omaha also slimmed the Bristol-Myers Squibb Co. (BMY, Financial) investment by 76.4%, or 16,844,262 shares, reducing the equity portfolio by 0.34%. During the quarter, shares traded around $58.67 apiece.

The New York-based biopharmaceutical giant closed Monday at a market cap of $145.63 billion, a per-share price of $66.81, a price-earnings ratio of 21.44, a price-book ratio of 4 and a price-sales ratio of 3.23.

According to the GuruFocus Value chart, the stock is fairly valued.

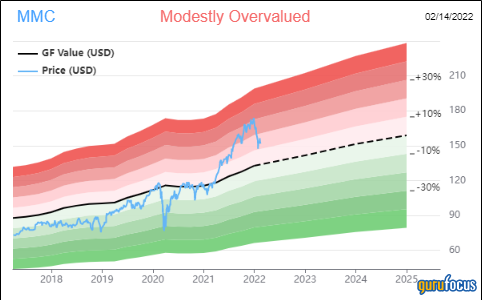

Marsh & McLennan Companies Inc.

Buffett sold 85.23% of the firm’s stake in Marsh & McLennan Companies Inc. (MMC, Financial), getting rid of 2,336,844 shares and trimming the equity portfolio by 0.12%. The average price of shares during the quarter was $166.42.

The New York-based global professional services and insurance brokerage firm has a market cap of $76.46 billion at Monday’s closing share price of $151.71. The price-earnings ratio was 24.74, while the price-book ratio was 6.80 and the price-sales ratio was 3.94.

The GuruFocus Value chart rates shares as modestly overvalued.

View all of Buffett’s trades here.