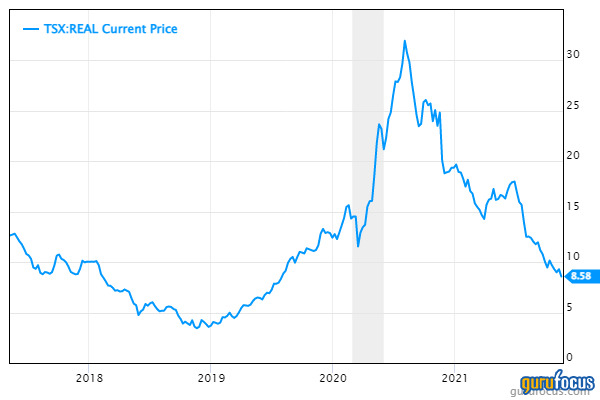

Real Matters Inc. (TSX:REAL, Financial) is a network management solutions company for the mortgage lending and insurance business in the U.S. and Canada. The company went public in 2017 and became a pandemic darling due to the uptick in real estate and refinancing. But it is now facing a pandemic bust.

The company's main segments include appraisal management and title and closing. The company, which is based in Markham, Ontario, has a market cap of 677 million Canadian dollars ($535.4 million), a trailing price-earnings ratio of 14.6 and a forward price-earnings ratio of 26.5.

As mortgage rates have risen, the number of refinancings and residential real estate transactions has come down. This has had a dramatic effect on the stock. However, the market may have ignored the strength of the platform and is overly fixated on short-term transaction volume.

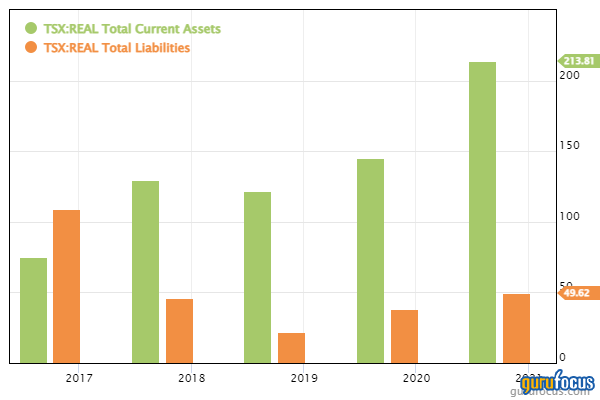

The company has a solid balance sheet with no net debt. GuruFocus rates its financial strength as 8 out of 10.

The GF Value shows the stock is significantly undervalued currently.

The company is in the process of buying back about 7% of its outstanding shares.

GuruFocus Earnings Power Value calculations, which assume "no growth," is showing a value of CA$7.37, close to the depressed stock price.

Given that the company's earnings per share growth has been well into the double digits, this is likely a good entry point for long-term investors.

Conclusion

With the current tax loss selling, the stock seems to be artificially depressed. The company has a pristine balance sheet and a proven tech-based platform. With the pandemic boom and bust behind it, I expect the company to do well as conditions normalize. The company is also an attractive acquisition target.