McCormick (MKC, Financial) is a high profit margin spice company with a considerable record of growth.

-Revenue Growth: 5%

-Earnings Growth: 12%

-Dividend Growth: 9%

-Current Dividend Yield: 2.54%

-Balance Sheet Strength: Fairly Strong

Overall, I think MKC would make a decent purchase at under $50. Conservatively, I’d propose investing in dips under $45.

When I analyzed McCormick a year and a half ago, I stated that I believe it would make a good investment at under $40 (it was roughly $38 at the time), and the stock price has since gone up nearly 30%. However, EPS has increased as well, so the valuation is still in the same ballpark as it was when my previous McCormick analysis was published.

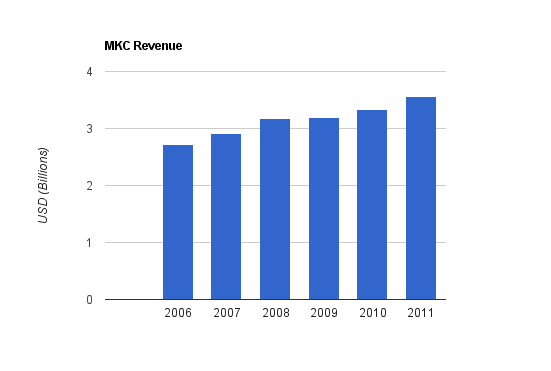

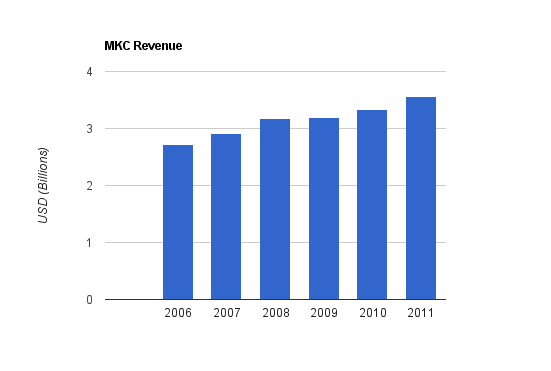

Revenue grew by an average of almost 5.2% per year over this time period. More recently, in the trailing twelve month period, revenue has grown by another 6.8% compared to 2010 annual revenue.

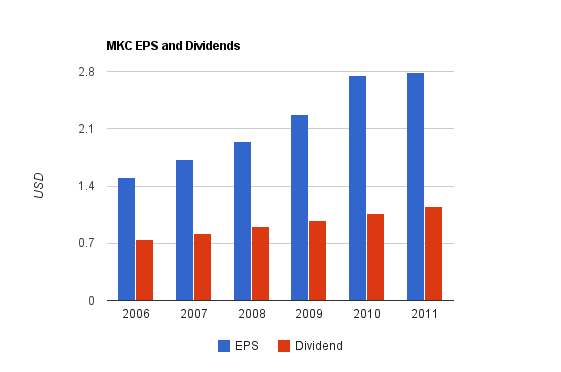

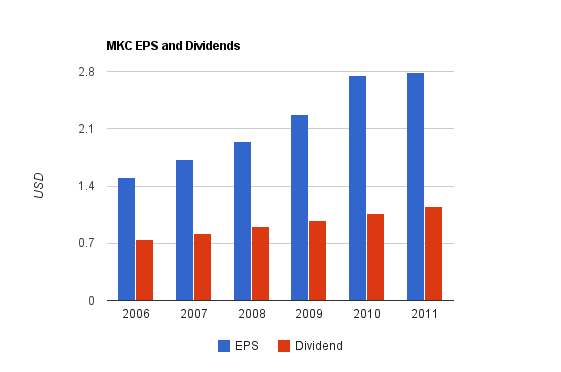

Earnings per Share grew at an average rate of 12% for this five-year period. This is higher than the roughly 8% growth rate for the first half of that decade. EPS has been nearly flat over the trailing twelve month period compared to 2010.

Cash flow has been static over the last several years. In the trailing twelve month period, cash flow is lower than 2005 levels. Free cash flow is a consistently strong portion of operating cash flow.

Price to FCF: 27

Price to Book: 3.8

Return on Equity: 25%

McCormick operates two main segments: consumer and industrial. The consumer segment, as of 2010, accounted for 60% of sales and 79% of operating income, while the industrial segment accounted for 40% of sales and 21% of operating income.

Dividends increased at an annualized rate of over 9%. The most recent quarterly increase was from $0.28 to $0.31, which is a 10.7% increase.

The earnings payout ratio is a conservative 45%, the yield is reasonable but a bit on the low end, and the dividend growth is solid.

The company is also aggressively expanding into China and India, and has also completed its largest acquisition in company history a couple of years ago. Asia/Pacific currently accounts for only 8% of McCormick revenue, but it’s growing at a rate that exceeds overall company growth, so there is a tremendous growth opportunity there and they are very keen on tapping into it.

McCormick is particularly interesting as a food company in that their products are rather expensive per unit of weight and volume. Spices only make up a tiny part of a meal. Like most of the food industry, the company faces headwinds from commodity costs, transportation costs, packaging costs, and so forth, but I believe their operations in the spice business may buffer them to some extent from these problems compared with companies that sell cheaper, larger, heavier foods in bigger packaging. The result of this is that McCormick has fairly solid net profit margins of over 10%. The company also has private-label products to capture some of the lower-margin spice purchases. I’m not too excited about investment opportunities in the food industry overall, but McCormick is more attractive than most others, in my opinion.

-Revenue Growth: 5%

-Earnings Growth: 12%

-Dividend Growth: 9%

-Current Dividend Yield: 2.54%

-Balance Sheet Strength: Fairly Strong

Overall, I think MKC would make a decent purchase at under $50. Conservatively, I’d propose investing in dips under $45.

When I analyzed McCormick a year and a half ago, I stated that I believe it would make a good investment at under $40 (it was roughly $38 at the time), and the stock price has since gone up nearly 30%. However, EPS has increased as well, so the valuation is still in the same ballpark as it was when my previous McCormick analysis was published.

Overview

McCormick and Company is a 120 year old spice business. They produce and sell spices, herbs, and seasonings the world-over to both individual buyers and businesses. The company grows both organically, and through acquisitions, and sources product material from 40 countries and sells its products in over 100 countries.Revenue, Earnings, Cash Flow, and Metrics

McCormick has had solid growth over the last five years, and over a longer time period as well.Revenue Growth

| Year | Revenue |

|---|---|

| 2010 | $3.337 billion |

| 2009 | $3.192 billion |

| 2008 | $3.177 billion |

| 2007 | $2.916 billion |

| 2006 | $2.716 billion |

| 2005 | $2.592 billion |

Earnings Growth

| Year | EPS |

|---|---|

| 2010 | $2.75 |

| 2009 | $2.27 |

| 2008 | $1.94 |

| 2007 | $1.73 |

| 2006 | $1.50 |

| 2005 | $1.56 |

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2010 | $388 million |

| 2009 | $416 million |

| 2008 | $315 million |

| 2007 | $225 million |

| 2006 | $311 million |

| 2005 | $339 million |

Metrics

Price to Earnings: 17.5Price to FCF: 27

Price to Book: 3.8

Return on Equity: 25%

Dividends

For McCormick, dividend growth has been solid, the payout ratio has remained reasonable, but the moderately high valuation keeps the dividend yield moderately low, at 2.54% currently. The company has increased its annual dividend consecutively for over 25 years.McCormick operates two main segments: consumer and industrial. The consumer segment, as of 2010, accounted for 60% of sales and 79% of operating income, while the industrial segment accounted for 40% of sales and 21% of operating income.

Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $1.15 |

| 2010 | $1.06 |

| 2009 | $0.98 |

| 2008 | $0.90 |

| 2007 | $0.82 |

| 2006 | $0.74 |

The earnings payout ratio is a conservative 45%, the yield is reasonable but a bit on the low end, and the dividend growth is solid.

Balance Sheet

MKC’s total debt/equity is a bit under 0.8, which is reasonable. Due to acquisitions, most of the shareholder equity consists of goodwill. The interest coverage ratio is a bit over 10, which is quite strong. Overall, I consider McCormick’s balance sheet to be not perfect, but rather solid.Investing Thesis

Developed countries are becoming increasingly health aware, and due to this, people will be looking for healthy yet flavorful foods more than in the past. Spices and herbs are a great way to add taste to food while keeping the meal healthy, or even increasing the healthiness of the meal.The company is also aggressively expanding into China and India, and has also completed its largest acquisition in company history a couple of years ago. Asia/Pacific currently accounts for only 8% of McCormick revenue, but it’s growing at a rate that exceeds overall company growth, so there is a tremendous growth opportunity there and they are very keen on tapping into it.

McCormick is particularly interesting as a food company in that their products are rather expensive per unit of weight and volume. Spices only make up a tiny part of a meal. Like most of the food industry, the company faces headwinds from commodity costs, transportation costs, packaging costs, and so forth, but I believe their operations in the spice business may buffer them to some extent from these problems compared with companies that sell cheaper, larger, heavier foods in bigger packaging. The result of this is that McCormick has fairly solid net profit margins of over 10%. The company also has private-label products to capture some of the lower-margin spice purchases. I’m not too excited about investment opportunities in the food industry overall, but McCormick is more attractive than most others, in my opinion.