There is no widely agreed definition of what value is. Not every cheap stock is a good value stock. Some are value traps. According to MSCI, the value investment style characteristics for index construction are defined using three variables: price-book ratio, forward price-earnings ratio and enterprise value-to-cash-flow-from-operations ratio,

Morningstar has its own, more complex, methodology for its Morningstar Style Box, which categorizes stocks from deep value to high growth. It can also be argued that stocks with a Piotroski F-Score of 8 or 9 are more likely than not to offer high future returns. GuruFocus has several excellent valuation tools and value screens, which I highly recommend making use of.

This article will be the first in my new series "UK Value," in which we will take a closer look at value stocks listed on the London Stock Exchange. Just as there is no one definition for value stocks, there will be no one metric used to define whether these names are value stocks or not. Instead, we will evaluate these names on a case-by-base basis depending on what valuation methods seem appropriate for each.

Tesco

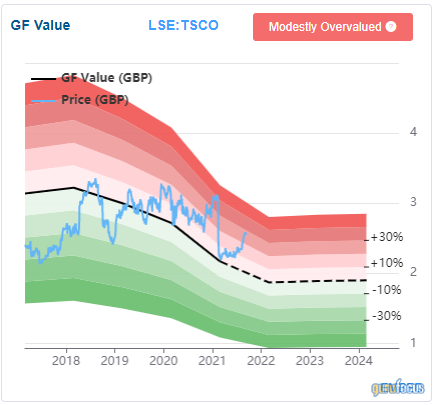

This first article is about Tesco PLC (LSE:TSCO, Financial), which is the UK's largest grocer in terms of sales and store network. The company has successfully completed an ambitious turnaround. Morningstar rates it as “Large-Value." Gurufocus has it as "Modestly Overvalued" - it seems this is a good example of "horses for courses" when it comes to defining value.

I own this stock because I think the dividend yield of nearly 4% is attractive, and with free cash flow set to recover as the UK economy continues to rebound, there is also a good prospect of a new share buyback program.

Tesco seems to be the forgotten member of the big four UK supermarket group for investors. In the last year, Asda was bought by private equity, Morrisons (LSE:MRW, Financial) is currently in a bidding war and speculation about a takeover at Sainsbury (LSE:SBRY, Financial) has lifted its share price.

Tesco shares have rallied recently too, but they have underperformed versus peers since the start of the pandemic, although they have beaten the FTSE 100 in this time too.

Relatively new CEO Ken Murphy is likely to focus on explaining his plans for use of free cash flow when the company reports its half-yearly earnings next month. Even though pandemic costs have dented margins, Tesco kept its dividend stable last year at 9.15 pence (13 cents) per share. Analysts expect the dividend to rise to 9.61 pence per share this year thanks to a recovery in profits and a stronger balance sheet thanks to the UK economic recovery, which has been driven by the strong vaccine roll-out.

Tesco’s fiscal year-end is in February, meaning their earnings come right at the end of earnings seasons in London. Fiscal year 2020 saw 1.38 billion Pounds ($1.91 billion) in free cash flow produced and the consensus is that this will rise to £1.57 billion by 2022. This excess cash is likely to be returned to shareholders through special dividends or buybacks as Tesco is already so dominant there isn’t much room for capex growth. Any new shareholder return strategy will likely be announced at the next full year earnings results in April next year.

The company made a smart move to sell its Asian business and focus on its core UK market. The Asian store sale helped fund a one-time £2.5 billion payment to the company’s defined benefit pension scheme, which puts the scheme back into balance, thereby reducing that liability. The sale also helped fund a £5 billion return of capital though special dividends and share buybacks. This shows good discipline from Tesco’s management. It’s quite possible that this could the precedent for exiting its non-core central European businesses, though the company has not yet announced any plans for this.

With the UK fast approaching something nearer to normality, Tesco’s profits should soon get back to the pre-pandemic levels as much of the Covid-related costs fade into history. Tesco’s scale and efficiency mean that is underlying retail operating margin has consistently been sector-leading and currently stands at 3.5% in an industry which gets is return on equity from asset turn, not margin.

According to market research firm Kantar, as with the other big three supermarkets, Tesco has been losing market share to discount players Aldi and Lidl over the past decade. This trend continuing is a risk in downturns, but less so in an economic upturn.

Tesco is slightly more expensive than Sainsbury’s, but a forward enterprise-value-to-Ebitda ratio of about 7 is towards the lower end of the range, that the shares have traded higher than that over the last few years. A takeover from private equity is possible but unlikely given Tesco’s size and political importance, but the very likely high shareholder returns are what interest me most. That's why I am long Tesco.