Action Semiconductors (ACTS, Financial) has been a perennial net-net since 2009. I started looking at it during the 2008-09 crises because the company was trading at 50 cents for a dollar. Here is the link to the article when I first looked at it Getting started - ACT(S)

Since the crises the company’s price almost doubled in 2010 and the significant margin of safety went away. However, with the recent spate of fraud (or potential fraud) in Chinese stocks, there is nervousness surrounding all Chinese stocks and ACTS (though not a Chinese stock but has most of its operation in China) has also suffered as a result.

I decided to take a re-look at the stock to see if the stock is appealing at current prices.

Company Background

ACTS is fabless semiconductor company that engages primarily in the businesses of designing, developing and marketing SoCs (Systems-on-a-Chip), for portable media players. ACTS primarily designs these chips but outsources manufacturing of all its products to third party contractors - He Jian, and United Microelectronics Corporation. ACTS provide these contract manufacturers monthly targets and thus retain lot of flexibility around what needs to BE produced. This allows company to have limited capital expenditure for manufacturing but also limited need to have a lot of inventory on their books. Company also uses independent vendors to help with testing and packaging functions depending on capacity constraints.

Company sells most of its products to value added distributors or contract manufacturers. Thus the company doesn’t have a lot of brand recognition.

Company Financials

The company was listed in November 2005 on Nasdaq through an IPO. In that respect it differs from many of the Chinese company which were created through reverse mergers. Company has also used Deloitte as its auditor for a long time which gives me added comfort. Without the above 2, I would not be looking at any Chinese company (this is actually based out of Cayman island).

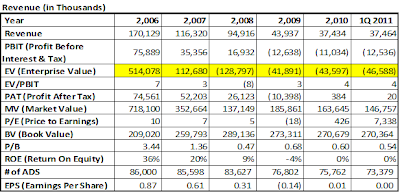

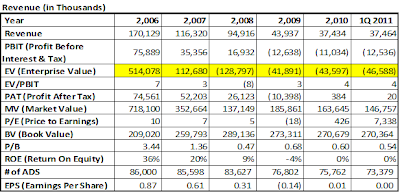

I have used annual reports for the 5 full years (2006-2010) and extrapolated the numbers from the 1st quarter of 2011 for 2011.

Assumptions:

A few key things stand out:

It is the negative Enterprise Value or “Net-Net” aspect that got me excited then and that gets me excited now as well.

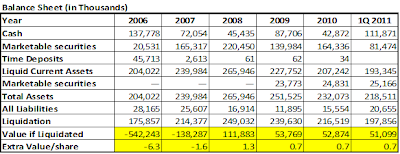

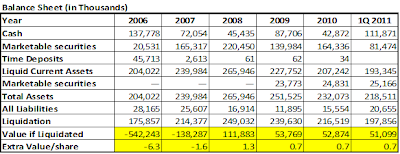

To better understand the value in the stock let us look at the Balance Sheet.

Balance Sheet

A few things stand out from looking at the balance sheet:

Qualitative Factor

Conclusion

Disclosure: I currently own ACTS.

Disclaimer: All views expressed in this article are the author’s own views. They don’t represent the views of any company or organization that the author may be affiliated with. This is not a recommendation to buy or sell a stock. You need to do your own diligence before buying or selling a stock.

Since the crises the company’s price almost doubled in 2010 and the significant margin of safety went away. However, with the recent spate of fraud (or potential fraud) in Chinese stocks, there is nervousness surrounding all Chinese stocks and ACTS (though not a Chinese stock but has most of its operation in China) has also suffered as a result.

I decided to take a re-look at the stock to see if the stock is appealing at current prices.

Company Background

ACTS is fabless semiconductor company that engages primarily in the businesses of designing, developing and marketing SoCs (Systems-on-a-Chip), for portable media players. ACTS primarily designs these chips but outsources manufacturing of all its products to third party contractors - He Jian, and United Microelectronics Corporation. ACTS provide these contract manufacturers monthly targets and thus retain lot of flexibility around what needs to BE produced. This allows company to have limited capital expenditure for manufacturing but also limited need to have a lot of inventory on their books. Company also uses independent vendors to help with testing and packaging functions depending on capacity constraints.

Company sells most of its products to value added distributors or contract manufacturers. Thus the company doesn’t have a lot of brand recognition.

Company Financials

The company was listed in November 2005 on Nasdaq through an IPO. In that respect it differs from many of the Chinese company which were created through reverse mergers. Company has also used Deloitte as its auditor for a long time which gives me added comfort. Without the above 2, I would not be looking at any Chinese company (this is actually based out of Cayman island).

I have used annual reports for the 5 full years (2006-2010) and extrapolated the numbers from the 1st quarter of 2011 for 2011.

Assumptions:

- I have assumed that 2011 numbers will be four times of what has been observed in the 1st quarter so far.

- MV has been derived by looking at the dilution share count at the end of period and multiplying by the market price at the end of the period.

- EV is MV – liquid current assets (there is no debt)

A few key things stand out:

- Revenue of the firm has shrunk dramatically over the last 5 years to 25% of what it did in 2006.

- Market value of the company has followed suit as well.

- This has resulted in Enterprise Value of the company becoming negative. It has been negative over the last 3 years. I actually looked at it in Feb 2009 (Getting started - ACT(S)) when things were looking quite bleak.

It is the negative Enterprise Value or “Net-Net” aspect that got me excited then and that gets me excited now as well.

To better understand the value in the stock let us look at the Balance Sheet.

Balance Sheet

A few things stand out from looking at the balance sheet:

- Company has increasingly put Cash to work into Marketable Securities to earn interest income (Q1 2011 seems to be an aberration).

- Liquid current assets has not changed much over the last 5 years, though it has gone down significantly since end of 2008.

- If the company were to be liquidated today the owners will get a 35% jump in value. This valuation is a very conservative valuation because I have excluded all assets which are not liquid. However, I have included all liabilities when coming up with Liquidation value.

Qualitative Factor

- ACTS had a change of guard last year with Niccolo coming as CEO in place of Nan-Horng. Niccolo is much more focused on Research and is aggressively building that team. The first result of that effort will be seen later in the year when their series 27 and series 28 products hit the tablet market.

- ACTS has been recently tied up with MIPS Technologies to bring Honeycomb (Android 3) to the MIPS architecture. It is the first positive news from ACTS in a long time.

- ACTS has also been investing heavily in the recent past. This is reflected in the reduction in Liquidation value in the last quarter.

Conclusion

- ACTS is trading at a significant discount to its cash value. This is reflected in the fact that if the firm were to liquidated today it will provide at least 35% return to its current holders.

- ACTS recently had good trial runs of its Series 27 and 28 products. These series are now moving in production and the tangible results of those should show up in the 2nd half of the year. It also recently tied up to support Android 3 on Tablet.

- The best part of buying ACTS is that you are not paying anything for the future. If things work out there is a significant upside. If they don’t there is still upside with the liquidation value. I prefer these type of situations J

Disclosure: I currently own ACTS.

Disclaimer: All views expressed in this article are the author’s own views. They don’t represent the views of any company or organization that the author may be affiliated with. This is not a recommendation to buy or sell a stock. You need to do your own diligence before buying or selling a stock.