On September 12, 2023, Eddy Hartenstein, a director at Broadcom Inc (AVGO, Financial), sold 1,500 shares of the company's stock. This move is part of a broader trend of insider selling at Broadcom Inc, which we will explore in more detail below.

Who is Eddy Hartenstein?

Eddy Hartenstein is a seasoned executive with a wealth of experience in the technology and media industries. He has served on the board of directors at Broadcom Inc, a global technology leader that designs, develops, and supplies a broad range of semiconductor and infrastructure software solutions. His insights and leadership have been instrumental in guiding the company's strategic direction.

About Broadcom Inc

Broadcom Inc is a leading designer, developer, and global supplier of a broad range of semiconductor and infrastructure software solutions. Broadcom's product portfolio serves critical markets including data center, networking, software, broadband, wireless, and storage and industrial. The company's solutions include data center networking and storage, enterprise, mainframe and cyber security software focused on automation, monitoring and security, smartphone components, telecoms and factory automation.

Insider Sell Analysis

Over the past year, the insider has sold a total of 4,675 shares and purchased 0 shares. This recent transaction on September 12, 2023, where the insider sold 1,500 shares, is part of this broader trend.

The insider transaction history for Broadcom Inc shows a total of 1 insider buy and 11 insider sells over the past year. This suggests a trend towards insider selling at the company.

The relationship between insider selling and stock price can be complex. Insider selling does not necessarily indicate a lack of confidence in the company. Insiders may sell shares for personal reasons or to diversify their investment portfolio. However, sustained insider selling over a period of time could be a red flag for investors.

Valuation

On the day of the insider's recent sell, shares of Broadcom Inc were trading for $855.68 apiece, giving the company a market cap of $359.76 billion. The price-earnings ratio is 26.82, which is higher than the industry median of 23.96 and lower than the company’s historical median price-earnings ratio.

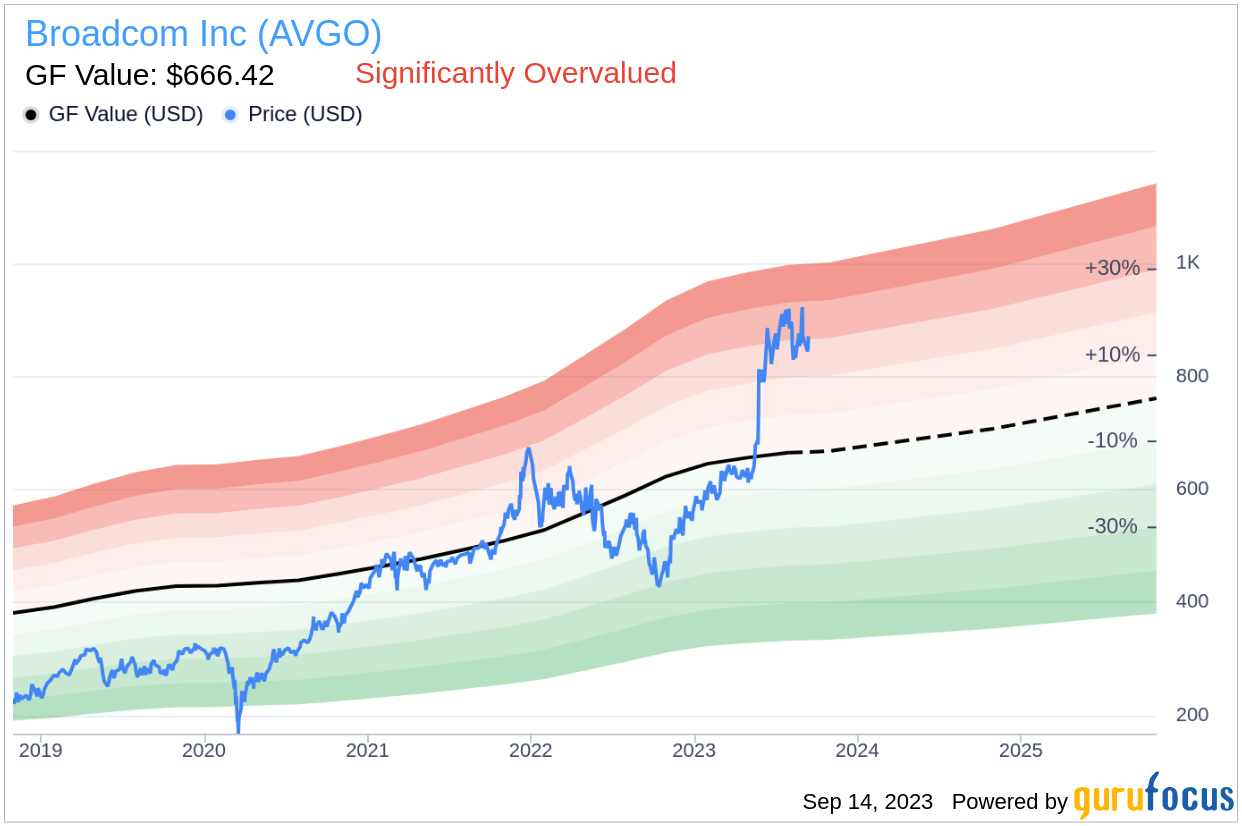

With a price of $855.68 and a GuruFocus Value of $666.42, Broadcom Inc has a price-to-GF-Value ratio of 1.28. This suggests that the stock is significantly overvalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company’s past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, while the insider's recent sell of Broadcom Inc shares is part of a broader trend of insider selling at the company, it does not necessarily indicate a lack of confidence in the company. Investors should consider the company's valuation and other factors when making investment decisions.