Palantir (PLTR, Financial) is a intelligence software company that was originally backed by the CIA and used in global military applications. Artificial Intelligence (AI) has been at the heart of its business model from day one, and the company was announced a Forrester leader in AI in 2022.

Between May 2023 and June 2023, Palantir’s stock price has skyrocketed by close to 100% as AI exuberance has caused a boom in momentum. The technical charts now show the stock is pulling back slightly. Could it offer a potential value opportunity now, or has its valuation become overheated? Let's take a look at the tailwinds surrounding Palantir as well as its financials and outlook in an attempt to determine an answer to that question.

AI tailwinds

In 2023, the company further enhanced its product range with a formal Artificial Intelligence Platform (AIP). AIP connects its Gotham and Foundry products to third party large language models.

Palantir's unique niche is that the company offers military-grade AI accessibility for businesses of all types. Security and privacy of data has been a major concern for many organizations, as the input data given to applications such as ChatGPT can be used to train the model (and thus indirectly help competitors). For companies in regulated industries such as financial services and health care, data security is table stakes.

In a June 2023 interview with Bloomberg, CEO Alex Karp praised the demand for Palantir’s software. He stated the company had “more inbound calls in a month, than they usually have in a year." He also hinted to its products being used in eastern Europe, which has helped Ukraine gain an edge against Russia, although full details are “classified."

In reference to the first quarter 2023 earnings call, Karp stated, “We have no pricing strategy… we are going to create a lot of value, we are going to get hundreds of customers and we will price it as we go."

Karp is known for being a unique individual, and this pricing strategy is nontraditional. However, in his defense, if Palantir's product is “the best on the market,” as he claims, capturing a portion of customer-generated value should not be an issue.

With regards to the underlying technology of Palantir's AIP, the company enables an enterprise to work with any large language model they desire from Open AI’s GPT-4 to Alphabet's (GOOG, Financial)(GOOGL, Financial) PaLm model.

Palantir's strategy is to focus on a fast, practical solution that enables AI to be rolled out in an enterprise context today, not in five years.

The company has already deployed a pre-formal release version of the product to a large insurance business, which is using the software to automate claims processing.

On the latest earnings call, Karp stated there is "tremendous demand" to use its AI to speed up the FedRAMP approval for companies. The FedRAMP process is a series of compliance activities a company must go through before being allowed to sell its products to government agencies. Palantir’s “FedStart” product aims to help startups to gain approval faster and the company has expanded its partnership with Microsoft (MSFT, Financial) to go to market faster.

Expanding financials

In the first quarter of 2023, Palantir reported solid financial results. Its revenue was was $525.19 million, which rose by 15% year over year and beat analyst forecasts by over $19.24 million.

This revenue growth rate has slowed down from the 34.39% in the fourth quarter of 2021. However, I believe this was mainly driven by the tough macroeconomic environment which has caused longer sales cycles across the enterprise software industry, as decision-makers slow down purchasing. A positive is I believe this is only a short-term issue and the rise of AI could act as a catalyst to spark buyer interest.

The majority (64%) of Palantir's revenue is derived from the U.S., with $337 million in U.S. revenue reported in the quarter, up 23% year over year.

U.S. government revenue contributed to the bulk of this at $230 million, up 22% versus the prior year. I believe this is a positive sign, as government contracts tend to offer stable cash flows and huge expansion opportunities.

Palantir's U.S. commercial segment has also continued to grow with $107 million revenue reported, up a solid 26% in relative to the prior year quarter.

Its customers vary across a range of industries from energy to health care and of course military applications. Therefore Palantir is diversified and not too vulnerable to a cyclical downturn in a specific industry.

Overall its customer base rose by 41% versus the prior year to 391 customers. This doesn’t seem like a lot, but that is the beauty of an enterprise-focused business-to-business model.

Palantir has been criticized for not being profitable, but in the first quarter the company proved it could turn its balance sheet around. Palantir reported positive operating income of $4.1 million. This was much better than the loss of $39.4 million reported in the first quarter of 2022 and the loss of $17.8 million reported in the fourth quarter of 2022. This was driven by a stabilization in its operating expenses, as well as solid top line growth.

Stock based compensation has been a major drag on the company's profitability, but this also improved from an eye watering 33% of revenue in the first quarter of 2022 to "just" 21.8% by the first quarter of 2023.

Palantir has a fortress balance sheet with $2.904 billion in cash and short term investments compared to $259 million in total debt.

Advanced valuation

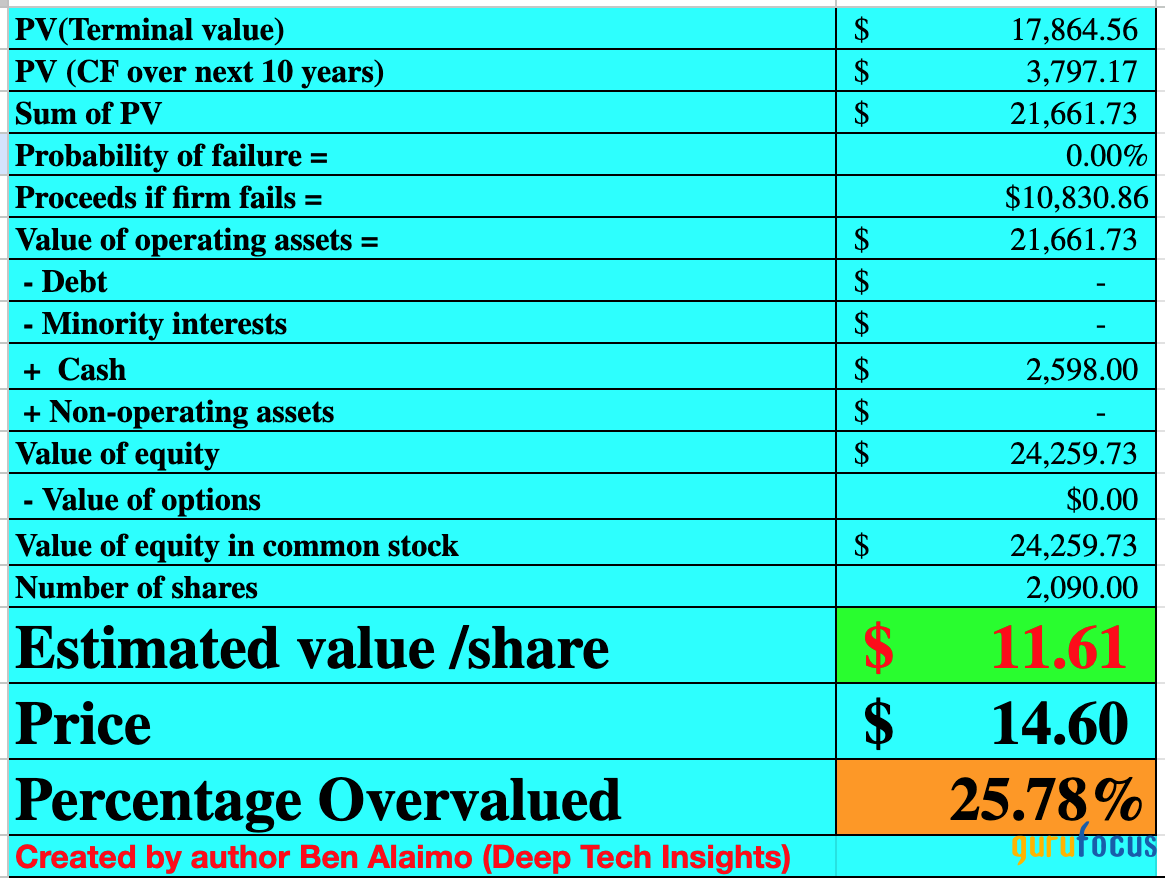

In order to value Palantir after its recent run-up in share price, I have input its financial data into my discounted cash flow model. I have forecast 18% revenue growth for the next year, which I believe is fairly conservative given the company reported 15% growth in the recent quarter, which was before the major AI product launches.

In years two through five, I have forecast a rapid 28% growth per year. I expect this to be driven by the huge boom in adoption of its AIP by enterprises and continued expansion with its existing customers.

Keep in mind this growth rate is also lower than its 40% rate generated in the first quarter of 2022. Therefore, as macroeconomic conditions improve, I believe a 28% growth rate is achievable.

Moving on to margins, I have forecast a 29% operating margin over the next eight years. I expect this to be driven by continued stabilization in its expenses in addition to lower costs of customer acquisition due to the excitement around the AI industry. I have also capitalized Research and Development expenses, which has boosted its margins.

Given these factors, I get a fair value estimate of ~$12 per share. Given the stock is trading at close to $15 per share at the time of writing, it is close to 26% overvalued according to my forecasts.

Final thoughts

Palantir is a cutting edge software company that is poised to benefit from growth in the big data and AI industries. The company has strong relationships with enterprises and a first mover advantage with regards to adoption. Its focus on privacy and security of data is also another advantage, and its military applications will likely always be in demand. The only issue is the huge momentum around the AI industry has baked in a lot of positivity for Palantir's stock. The company may surpass the growth rates I have estimated, and thus if investors believe so it could seem undervalued even after the run up in share price. However, I personally prefer to be a contrarian when investing, and given my model indicates the stock is overvalued, a place on my watch list looks to be more prudent at this time, until the stock pulls back more.