Lennar Corp (LEN, Financial) has recently shown a notable daily gain of 5.25%, with an 11.33% gain over the past three months. Additionally, the company boasts a robust Earnings Per Share (EPS) of 14.27. However, the critical question remains: is Lennar significantly overvalued? This analysis aims to explore this query thoroughly, encouraging readers to delve into the financial metrics and intrinsic valuation of Lennar.

Company Overview

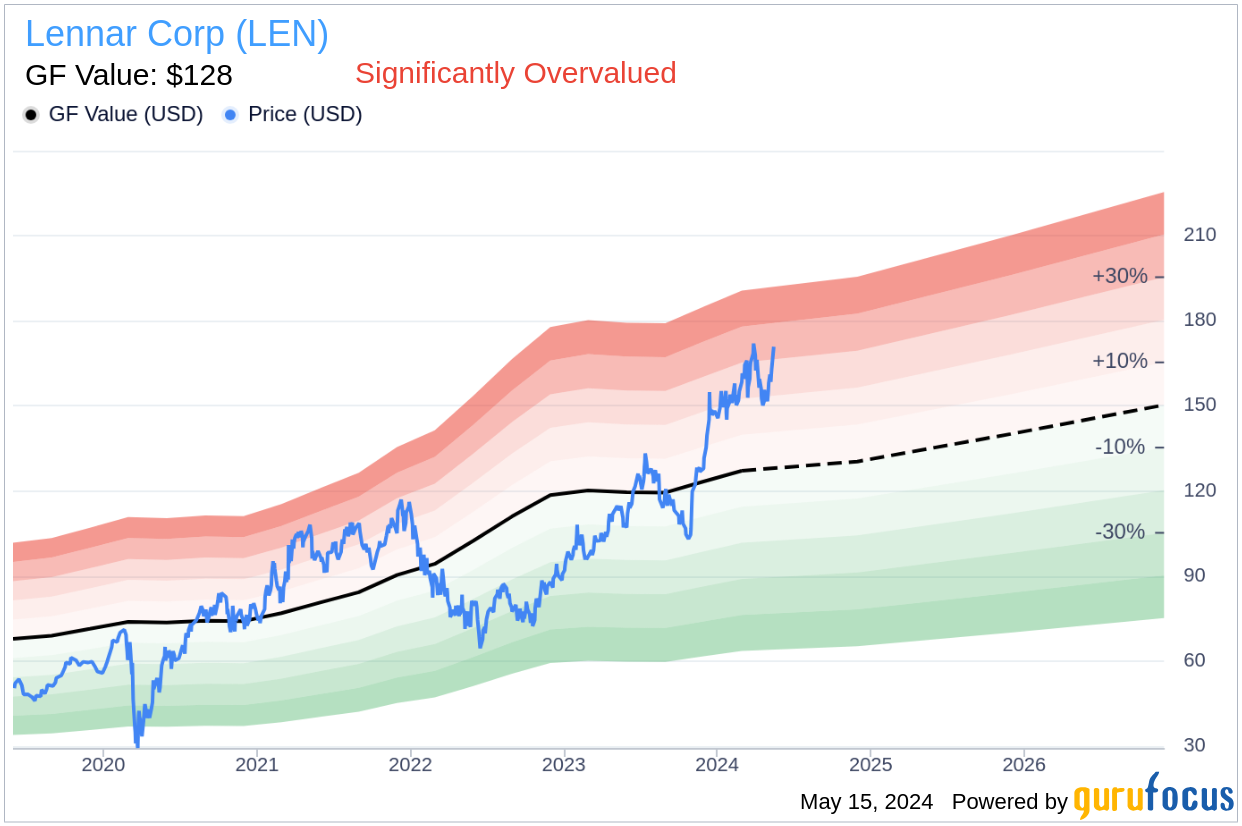

Lennar, one of the largest public homebuilders in the United States, primarily serves first-time, move-up, and active adult homebuyers under the Lennar brand. Based in Miami, Lennar's operations extend to financial services, providing mortgage financing and related services to its homebuyers. Additionally, the company is engaged in multifamily and single-family for rent constructions and has stakes in various housing-related technology startups. Currently, with a stock price of $170.85, Lennar's market cap stands at $47.10 billion, significantly above its GF Value of $128, suggesting a potential overvaluation.

Understanding GF Value

The GF Value is a proprietary measure calculated to estimate the intrinsic value of a stock. It incorporates historical trading multiples such as PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow, alongside a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. According to this metric, Lennar (LEN, Financial) appears significantly overvalued at its current price, which may lead to poorer future returns compared to its business growth.

Financial Strength and Stability

Investing in companies with robust financial health reduces the risk of significant losses. Lennar's cash-to-debt ratio is 1.2, ranking better than 72.55% of its peers in the Homebuilding & Construction industry. This strong financial position is further supported by an overall financial strength rating of 8 out of 10.

Profitability and Growth Prospects

Lennar has maintained profitability over the past decade, with a recent annual revenue of $35.10 billion and an operating margin of 15.77%, ranking better than 76% of its industry counterparts. The company's growth metrics are also impressive, with a 3-year average EBITDA growth rate of 23.3%, surpassing 64.63% of competitors in the Homebuilding & Construction industry.

Evaluating Return on Investment

Comparing Return on Invested Capital (ROIC) against the Weighted Average Cost of Capital (WACC) provides insight into value creation. Lennar's ROIC over the past year stands at 13.48%, exceeding its WACC of 12.24%, indicating effective capital management.

Conclusion

While Lennar (LEN, Financial) exhibits strong financial health, profitability, and growth, its current market price significantly exceeds the GF Value, suggesting it is overvalued. Investors should consider this analysis to make informed decisions. For a deeper dive into Lennar's financials, visit Lennar's 30-Year Financials.

To discover other high-quality companies that may deliver above-average returns, explore the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.